PressDebitCards are especially attractive due to their low cost. Users will not only pay lower transaction fees on daily purchases, but will also have an immediate ($150) yearly savings by only paying $19.95/year for their Press debit Card. This is an excellent savings when compared to the average $15/month that other debit cards and banks tend to charge.

PressOnDemand at a Glance

PressOnDemand, one of the first revolutionary online goods and services marketplaces, is changing the way business is done. As a hybrid, on-demand global service platform, Press utilizes patent machine-learning technology to help connect users and customers in the global online world of business.

Clients are able to quickly and easily access hundreds of fully qualified service providers within a 50-mile radius. With the development of their AI technology, PressOnDemand has also introduced their own app, through which users can also sell and purchase high-quality, trending products worldwide.

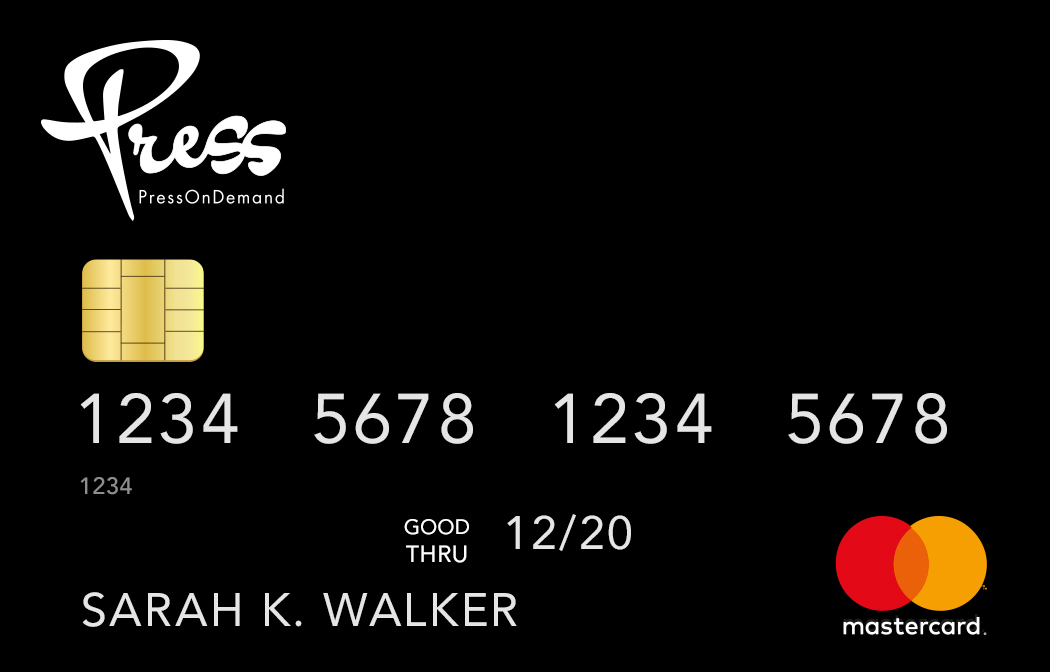

How Do Press Debit Cards Work?

Press debit cards work just like any bank or debit/credit card. Because it’s a global debit card, users can use it to easily complete transactions digitally and through merchant terminals (almost) anywhere in the world. As long as you’re located in one of the approved 210 countries and the merchant accepts Mastercard, your Press Debit Card is as good as gold.

In other words: a PressDebitCard will allow you to receive payment commissions digitally in minutes flat. Afterwards, you’ll be able to use those funds to purchase everyday life essentials (such as withdrawing money from the ATM, buying groceries, gas, etc.)

Press Debit Cards are SECURE

As is the case with the PressOnDemand website and app payment platform, the PressDebitCard benefits from military-grade encryption and high-end security. Because the information being exchanged through the portal is often highly sensitive, Press make it a priority to ensure that their users are safe and secure at all times.

Press also offers free customer service. If you run into any issues with your PressDebitCard, Press representatives will be available at no additional cost to aid you in solving the problem.

Lower Cost with the PressDebitCard

With the PressDebitCard, no bank account is needed. This makes the Press Debit Card a global solution for billions of unbanked users. Don’t like using banks? Not a problem. Don’t have access to traditional banking? Press has got you covered.

On the other hand, for users who do use banks, Press also allows you to transfer funds to your bank account. The best part: regardless of your banking situation (or lack thereof), you’ll still be enjoying low transaction fees.

In fact, lower transaction fees aren’t the only financial benefit to using the Press Debit Card. As mentioned earlier, while most banks and online debit cards charge an average of $15/month, the PressDebitCard only asks for $19.95/year. What card can beat that?

The Future of Mobile Payments is Here

The world we live in is well on its way to becoming a cashless society and PressOnDemand is along for the journey by stepping up to a leader role in this global mobile payment revolution.